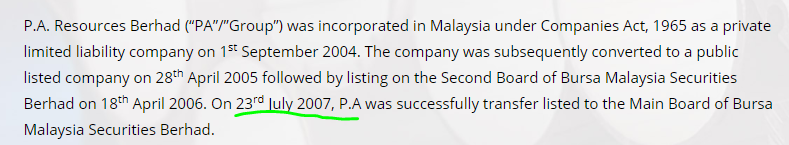

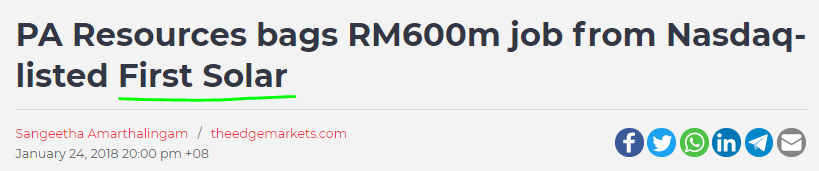

Last article about PA, we decided to share one more, since PA have already go new recent high. We shared at RM 0.125, hit high RM 0.17 today, its 36% just within 4 day!

So what is interesting in JAG? To me JAG (0024) is much more interesting compare to PA, that's why I have to share it before it go up another 36% or even 50%.

Again JAG (0024) have long history in BURSA, I like it, the longer they around, mean they are there to make money, and it should fly high once it wake up.

JAG (0024) was incorporated on 14 July 1997, but the game changer is after reverse acquisition of Jaring Metal Industries Sdn. Bhd., a reputable Total Waste Management solutions provider on 10 December 2013. To reflect the change in core business, Infortech Alliance Berhad has been renamed JAG Berhad with effect from 16 June 2014.

Why is this company look interesting for now? Again similar to PA, the things they do related to commodity, but this time round is COPPER, TIN, SILVER and gold.

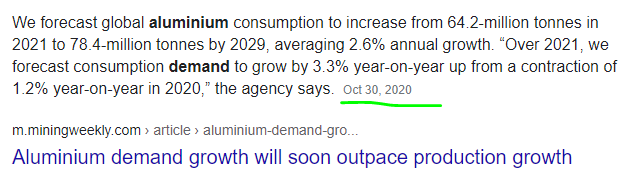

So very quick, we look at COPPER price first :

New high !! If you look at monthly chart, its 3 year new high now !! For sure latest result will see even better earning.

Even Tin price also rocket up lately:

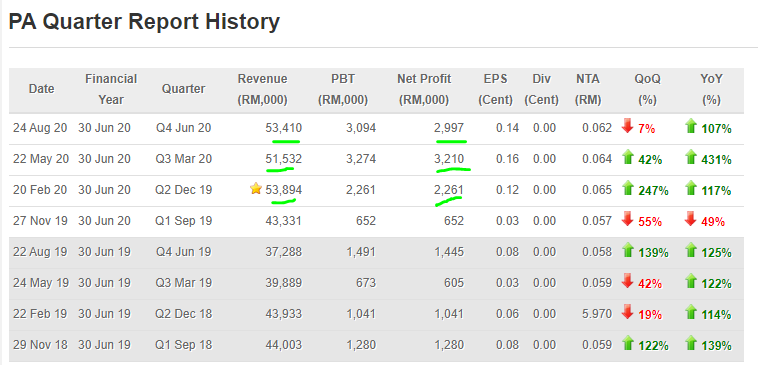

This is purely based on if the company profit dint growth. But imagine commodity price shoot up sky, sure earning should increase as their business is direct related to it.

Current price only at PE 11-12, compare to PA already PE 36-39, so JAG definitely is still undervalues !!

Beside we already know the private placement price at around RM 0.15, which mean the bottom is there already, max loss 4-5 cent, but max gain can be a lot.

Not only that, the company already double their production, which should see even confirm that coming result will do even better:

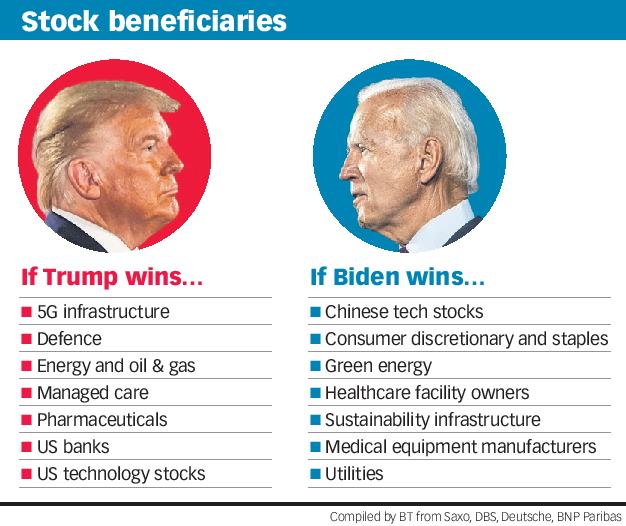

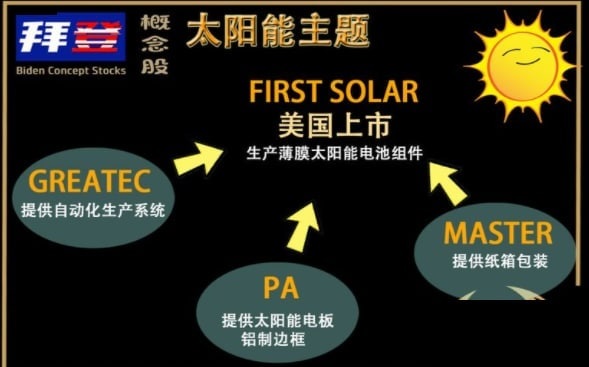

Beside, they also doing renewal energy, which seems to be super hot cakes lately:

I am expecting if they manage to get this project, price shall go limit up even ! Dont play play ! Huge contribution from this project if they manage to bid it. It will be bonus for this company, if fail the bid also doesn't matter as current e-waste business already can make stable income.

Talk so much, forget about the price chart, lets us have a look:

If you look at Monthly chart, its obvious volume recently and price still big bottom ! Monthly chart resistant at RM 0.30 and RM 0.40, if this two level can break, then should limit up like year 2014 !

If we look at daily chart, its a big round bottom up pattern, once break RM 0.22 is very strong breakout already !! Chart already speak, is up to you to take action or not already.

Wait a minute !

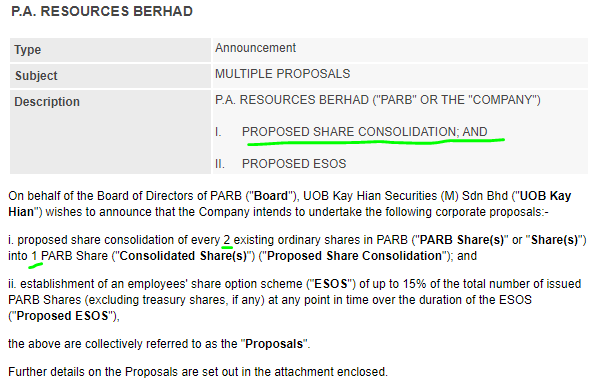

Why 24 Aug 2020 price chart gap up? Wow share consolidation again ! Just like VIVOCOM ! Share become less ! Although price did not move up immediately, it choose to consolidate 3 month only start moving.

We can obviously see that RM 0.15-RM 0.16 is bottom already, recently already start have small action, once break RM 0.24-RM 0.25 which mean super bull mari !! Because if it manage to pass share consolidate price, it usually mean super bull. Could fly like VIVOCOM !

As a conclusion,

1. JAG is on a strong recovery trend in technical and fundamental.

2. Demand and price for Copper, Gold, Tin all metal commodity is increasing.

3. JAG just done share consolidate, less share which we can see VIVOCOM, PA and many other case price will goreng up big.

4. They also doing Solar business, which going to give extra profit contribution in future.

5. The price is just waking up, it will continue to go higher and higher.

this article is just info sharing, not buy or sell call, please take ur own risk and get advice from your dealer or remisier.