ETORO is a very good platform for investment or specualting.

This is a platform for trader to trade (buy/sell) USA stock, Index, Gold, Oil, can leverage, can buy/sell BITCOIN, ETHEREUM, RIPPLE and many more.

Can trade by using their apps also.

Need to fill in details when sign up, after complete then can see what can trade inside.

When made decision only put fund in to trade.

Click this link to join now !

http://partners.etoro.com/A65802_TClick.aspx

No problem with withdrawal and deposit so far I have tested !

Not just TA or FA analysis, Logic Analysis will show more magic in Bursa Malaysia Stocks !

Disclaimer: This is my personal logic trading analysis blog that show my own personal analysis. All information provided here are for sharing purposes only. The author should not be held liable for any informational errors, incompleteness or for any actions taken in reliance on information contained herein. Buy at your own risk.

Can join my telegram channel to see my live trading ideas at

https://t.me/ltachannel

Can join my telegram channel to see my live trading ideas at

https://t.me/ltachannel

Thursday, December 7, 2017

Monday, November 20, 2017

TRIPLC - Sure Win ZERO Risk, Take Opportunity now !

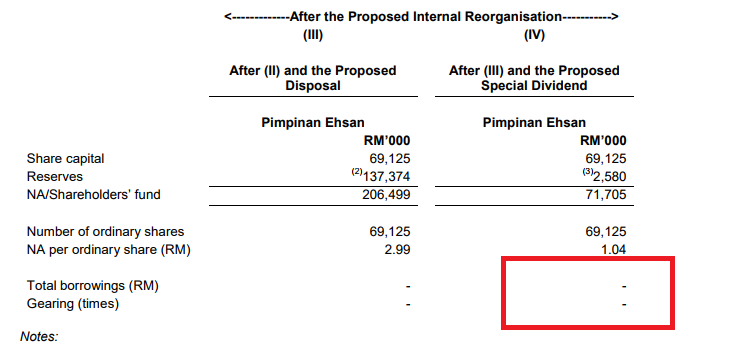

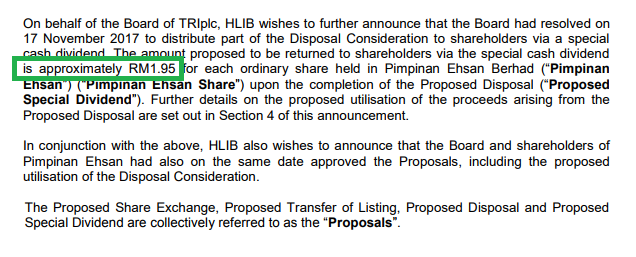

Last Friday just announce proposed RM 1.95 dividend but many din't notice as this is not a Hot stock. But to make it simple, this stock worth easily above RM 2.80 as they will have cash of RM 3.03 (RM 210 million) from the sell to PUNCAK.

To cut short, this company will sitting cash per share RM 3.03 (RM210) nett cash no debt and everything.

Current price RM 2.30 if dint move until entitle dividend will be RM 2.30 - RM 1.95 = RM 0.35.

However don't forget the company have cash RM 3.03 which mean RM 3.03 (cash) - RM 1.95 (dividend ) = RM 1.08 (cash still in hand)

Which mean If price only RM 2.30, if entitle dividend at this price will be left RM 0.35, which is still 3 x cheaper compare to the cash they have RM 1.08.

Hold tight and surely will win very good return !

Last chance before everything notice the big cash value still haven't be notice.

Dont forget if they take over some business later, or being take over by other good company like TECNIC - ROHAS case, it will surely big up some more !

See picture below on TECNIC case !

To cut short, this company will sitting cash per share RM 3.03 (RM210) nett cash no debt and everything.

Current price RM 2.30 if dint move until entitle dividend will be RM 2.30 - RM 1.95 = RM 0.35.

However don't forget the company have cash RM 3.03 which mean RM 3.03 (cash) - RM 1.95 (dividend ) = RM 1.08 (cash still in hand)

Which mean If price only RM 2.30, if entitle dividend at this price will be left RM 0.35, which is still 3 x cheaper compare to the cash they have RM 1.08.

Hold tight and surely will win very good return !

Last chance before everything notice the big cash value still haven't be notice.

Dont forget if they take over some business later, or being take over by other good company like TECNIC - ROHAS case, it will surely big up some more !

See picture below on TECNIC case !

Picture tell no more debt, only cash.

Tecnic also same sell business and give cash out, and price up double after cash out twice dividend, and later ROHAS take over it and go up again !

Tuesday, September 12, 2017

N2N - SuperDuper Bull In The Making

If you haven't read my sharing blog post on N2N (0108), please study the link below first:

N2N - The Market know How

https://klse.i3investor.com/blogs/logictradinganalysiss/131130.jsp

N2N - Fundamental Analysis LTA Style

https://klse.i3investor.com/blogs/logictradinganalysiss/131466.jsp

N2N - Technicaly Analysis Since IPO

https://klse.i3investor.com/blogs/logictradinganalysiss/131958.jsp

Today I going to share some more about N2N on why this will be a SuperDuper Rally.

You should already know that in previous post I mentioned that the company going to make great profit, still undervalues, and Risk Reward is very good.

At first lets us review the recent stock price movement:

We can finally see another test of RM 1.00 is coming with very strong volume which already very ready for a breakout. And people used to say third time test surely high chance to break.

And previous post on technical analysis already mentioned that after break RM 1.00 then SuperDuperBull will start !

Why is this going to happen? First of all we need to know why it's so bullish, but we already explain in all the past 3 article mention above, so I tell you some other simple information that might give you a clear mind why we should not miss this opportunity when its's still below RM 1.00 !

Look ! History tell after break RM 1.00 will be SuperDuperBull, and this time I highly believe it's going to repeat again !

Why is this happen? We share to you one simple trick ! That's the reason why Operator don't want you to collect below RM 1.00 previously and keep park selling blocking near RM 1.00 !

Look at this chart carefully you can easily understand that every single bid below RM 1.00 it's going to take RM 0.005 cent to go up ! But after RM 1.00, every bid up is RM 0.01 cent !

Still not understand?

for example :

Price from RM 0.90 to RM 1.00 = UP RM 0.10 cent

RM 0.90, RM 0.905, RM 0.91, RM 0.915, RM 0.92, RM 0.925, RM 0.93, RM 0.935, RM 0.94, RM 0.945, RM 0.95, RM 0.955, RM 0.96, RM 0.965, RM 0.97, RM 0.975, RM 0.98, RM 0.985, RM 0.99, RM 0.995, RM 1.00.

In this process, it take up total 21 bid to go up. Simply mean every bid will have a lot seller blocking which trader will always sell and causing a lot road block. 21 bid become a very big burden for operator to push up.

However after break RM 1.00.

From RM 1.00 to RM 1.01 = UP RM 0.10 cent

RM 1.00, RM 1.01, RM 1.02, RM 1.03, RM 1.04, RM 1.05, RM 1.06, RM 1.07, RM 1.08, RM 1.09, RM 1.10.

It only take 11 bid to go up same amount of RM 0.10 cent !!

That's one of the reason after break RM 1.00 will be much more bullish !

Some more !

USD have been weaken and this will benefited N2N as they have USD loan ! Forex gain at least 2-3% this quarter !

Some more !

There is a saying, if you not afford to buy BURSA (1818), buy N2N (1818) lah !

Why ??

Because when market bull, BURSA make more money, same to N2N ! A great cheap proxy !

Some more !

Look who are their big shareholder !? Nikkei Inc ! Quick Corp ! These are super strong company in Japan !

Got such strong company as shareholder, got what to scare? It will only help N2N to grow and Meletup ! See below they going to roll out something call QUICK PRO in JAPAN and across Asia !

source:

http://www.thestar.com.my/business/business-news/2016/10/13/potential-jump-in-earnings-for-n2n-from-hk-purchase/

Got more income is coming !

Some more !

source: http://www.theedgemarkets.com/article/n2n-connect-expand-asian-footprint

N2N market shares up to 70% ! Super huge ! King !

Some more !

The company already have plan to transfer to mainboard long ago ! Transfer to mainboard usually market will goreng up ! We can see HSSEB, SALUTE, and many others as example !

Some more !

By looking at the chart year 2014 to 2017, the chart actually show the trading volume is very low, whereby operator don't really have much chance to collect well. And average cost mostly within RM 0.70 - RM 0.90.

Look at recent chart movement we know that they have no choice to immediately collect at this level ! And there will be last collection ! After break RM 1.00 then time to SuperDuperRally ! Make them push higher ! Don't give them chance to collect low !

As a conclusion,

1. Once N2N break RM 1.00 price will push up very fast.

2. After break RM 1.00 can more easy go up due to less bid needed.

3. USD weaken benefited N2N for forex gain on USD loan.

4. N2N a cheap proxy of BURSA as both related to financial investment services.

5. N2N big shareholder Nikkei Inc and Quick Corp is a very strong background company.

6. N2N got plan to move Mainboard which will potential goreng up.

7. It's might be chance to collect below RM 1.00 before it SuperDullyRally BULL !

Again I further increase my short term hope to reach RM 1.30, mid term hope RM 1.88, long term hope RM 2.50.

Above are purely sharing information that might have errors cause by human mistake, miscalculation, and for education and personal reference only.

N2N - The Market know How

https://klse.i3investor.com/blogs/logictradinganalysiss/131130.jsp

N2N - Fundamental Analysis LTA Style

https://klse.i3investor.com/blogs/logictradinganalysiss/131466.jsp

N2N - Technicaly Analysis Since IPO

https://klse.i3investor.com/blogs/logictradinganalysiss/131958.jsp

Today I going to share some more about N2N on why this will be a SuperDuper Rally.

You should already know that in previous post I mentioned that the company going to make great profit, still undervalues, and Risk Reward is very good.

At first lets us review the recent stock price movement:

We can finally see another test of RM 1.00 is coming with very strong volume which already very ready for a breakout. And people used to say third time test surely high chance to break.

And previous post on technical analysis already mentioned that after break RM 1.00 then SuperDuperBull will start !

Why is this going to happen? First of all we need to know why it's so bullish, but we already explain in all the past 3 article mention above, so I tell you some other simple information that might give you a clear mind why we should not miss this opportunity when its's still below RM 1.00 !

Look ! History tell after break RM 1.00 will be SuperDuperBull, and this time I highly believe it's going to repeat again !

Why is this happen? We share to you one simple trick ! That's the reason why Operator don't want you to collect below RM 1.00 previously and keep park selling blocking near RM 1.00 !

Look at this chart carefully you can easily understand that every single bid below RM 1.00 it's going to take RM 0.005 cent to go up ! But after RM 1.00, every bid up is RM 0.01 cent !

Still not understand?

for example :

Price from RM 0.90 to RM 1.00 = UP RM 0.10 cent

RM 0.90, RM 0.905, RM 0.91, RM 0.915, RM 0.92, RM 0.925, RM 0.93, RM 0.935, RM 0.94, RM 0.945, RM 0.95, RM 0.955, RM 0.96, RM 0.965, RM 0.97, RM 0.975, RM 0.98, RM 0.985, RM 0.99, RM 0.995, RM 1.00.

In this process, it take up total 21 bid to go up. Simply mean every bid will have a lot seller blocking which trader will always sell and causing a lot road block. 21 bid become a very big burden for operator to push up.

However after break RM 1.00.

From RM 1.00 to RM 1.01 = UP RM 0.10 cent

RM 1.00, RM 1.01, RM 1.02, RM 1.03, RM 1.04, RM 1.05, RM 1.06, RM 1.07, RM 1.08, RM 1.09, RM 1.10.

It only take 11 bid to go up same amount of RM 0.10 cent !!

That's one of the reason after break RM 1.00 will be much more bullish !

Some more !

USD have been weaken and this will benefited N2N as they have USD loan ! Forex gain at least 2-3% this quarter !

Some more !

There is a saying, if you not afford to buy BURSA (1818), buy N2N (1818) lah !

Why ??

Because when market bull, BURSA make more money, same to N2N ! A great cheap proxy !

Some more !

Look who are their big shareholder !? Nikkei Inc ! Quick Corp ! These are super strong company in Japan !

Got such strong company as shareholder, got what to scare? It will only help N2N to grow and Meletup ! See below they going to roll out something call QUICK PRO in JAPAN and across Asia !

source:

http://www.thestar.com.my/business/business-news/2016/10/13/potential-jump-in-earnings-for-n2n-from-hk-purchase/

Got more income is coming !

Some more !

source: http://www.theedgemarkets.com/article/n2n-connect-expand-asian-footprint

N2N market shares up to 70% ! Super huge ! King !

Some more !

The company already have plan to transfer to mainboard long ago ! Transfer to mainboard usually market will goreng up ! We can see HSSEB, SALUTE, and many others as example !

Some more !

By looking at the chart year 2014 to 2017, the chart actually show the trading volume is very low, whereby operator don't really have much chance to collect well. And average cost mostly within RM 0.70 - RM 0.90.

Look at recent chart movement we know that they have no choice to immediately collect at this level ! And there will be last collection ! After break RM 1.00 then time to SuperDuperRally ! Make them push higher ! Don't give them chance to collect low !

As a conclusion,

1. Once N2N break RM 1.00 price will push up very fast.

2. After break RM 1.00 can more easy go up due to less bid needed.

3. USD weaken benefited N2N for forex gain on USD loan.

4. N2N a cheap proxy of BURSA as both related to financial investment services.

5. N2N big shareholder Nikkei Inc and Quick Corp is a very strong background company.

6. N2N got plan to move Mainboard which will potential goreng up.

7. It's might be chance to collect below RM 1.00 before it SuperDullyRally BULL !

Again I further increase my short term hope to reach RM 1.30, mid term hope RM 1.88, long term hope RM 2.50.

Above are purely sharing information that might have errors cause by human mistake, miscalculation, and for education and personal reference only.

Monday, September 11, 2017

N2N - Technical Analysis Since IPO

This blog post will be mainly discuss about the pass historical technical chart of N2N (0108) until today, how it evolve and how much it worth going in future.

From HISTORICAL Technical Chart

We Found RISK REWARD is SUPERB ! Read till finish to find out why !

If you haven't read about my blog about N2N introduction and it's fundamental analysis, you can go to link below:

http://bursalogicanalysis.blogspot.my/2017/08/n2n-market-know-how.html

http://bursalogicanalysis.blogspot.my/2017/09/n2n-fundamental-analysis-lta-style.html

Of course this company have long journey and history and riding on a roller coastal faith as it goes through the financial crisis in year 2008. We can see from the chart below:

Since IPO price of RM 0.41, price start moving up to as high as RM 2.53, and close highest at RM 2.49 in year 2017. Just two year after IPO price manage to Super Meletup up simply due to that time not much technology stock that listed in BURSA I assume.

But this rally not just due to world market bullish, we found out that it's also simply due to profit has been increase strongly after 2 years of IPO.

What's the great product make them so bullish? During that time, actually not much trader trade online, mostly offline, where their software mostly for Remisier, Bank Dealers, Institute and maybe some advance trader.

We can see a strong recovery after implementation of TCPro in second half of 2011, and financial stock market also start recovery. After Malaysia Election year 2013 over, our market turn bullish in year 2014 and price also spike up. During this time, online trader also started to actually growing faster and more than before.

During 2014 stock price already ever hit high of RM 1.10, and in 2016 also ever hit high at RM 1.07.

We can see from profit, year 2012 start to improving until today year 2017.

Current price RM 0.95.

From HISTORICAL Technical Chart

We Found RISK REWARD is SUPERB ! Read till finish to find out why !

If you haven't read about my blog about N2N introduction and it's fundamental analysis, you can go to link below:

http://bursalogicanalysis.blogspot.my/2017/08/n2n-market-know-how.html

http://bursalogicanalysis.blogspot.my/2017/09/n2n-fundamental-analysis-lta-style.html

From my findings, N2N listing IPO date estimated to be 25-11-2005, which almost 12 years in BURSA!

Of course this company have long journey and history and riding on a roller coastal faith as it goes through the financial crisis in year 2008. We can see from the chart below:

Since IPO price of RM 0.41, price start moving up to as high as RM 2.53, and close highest at RM 2.49 in year 2017. Just two year after IPO price manage to Super Meletup up simply due to that time not much technology stock that listed in BURSA I assume.

(This price is already adjusted due to 1:1 Bonus issue in 2007, and right issue in year 2013.)

Zoom in year 2005 to 2007, we can see N2N riding on a SUPER BULL rally, as that time market also very bullish. Especially when it break RM 1.00, the price push up much more faster than before.

We can see the company before IPO already improving in their profit, in year 2005 net profit at RM 1.8 million, in year 2006, one quarter already RM 3 million +. That's the obvious reason why N2N bullish that time.

What's the great product make them so bullish? During that time, actually not much trader trade online, mostly offline, where their software mostly for Remisier, Bank Dealers, Institute and maybe some advance trader.

We can obviously see that, during that old times, they still use PDA phones, even SMS still use, however over time, they manage to improve all this system which din't make them fail until today still survive.

What happen after the bull run of 2005-2007? Financial market crash.

What happen after the bull run of 2005-2007? Financial market crash.

We can see a huge damage and waterfall from year 2007 to year 2012.

It's pretty obvious during that time almost all company not doing well, highly impacted by world financial crisis causes by the collapses of Lehman Banks. This is tough time for N2N because bank business not doing well, same to stock market trading activities has been slow down very much.

I dig out the quarterly report of year 2nd quarter 2011, surprisingly notice that although they are not making profit for almost 2.5 years, they still manage to stay nett cash without much debt, even until now.

Recovery plan on the go !

Recovery plan on the go !

The company manage to overcome the crisis and go stronger with new product call TCPro Application. (should be more advance and useful compare to before, and have been widely used by many banks and traders now)

We can see a strong recovery after implementation of TCPro in second half of 2011, and financial stock market also start recovery. After Malaysia Election year 2013 over, our market turn bullish in year 2014 and price also spike up. During this time, online trader also started to actually growing faster and more than before.

During 2014 stock price already ever hit high of RM 1.10, and in 2016 also ever hit high at RM 1.07.

We can see from profit, year 2012 start to improving until today year 2017.

We can obviously see in year 2016 profit already double compare to the profit in year 2014.

We can see annual profit of 2016 already double year 2013 and 2014, however if we look at the stock price below, it's highly unmatched as the profit grow but price stock stay undervalue.

Very obvious that during year 2014 price have peak, but in 2016 stock price performance fail to overcome year 2014 even though profit have double.

What's next? What can we tell from all the story above?

N2N price already undervalue and not yet moving in tandem with latest profit which show potential of future growth !

RISK REWARD is extremely good !

By using the average of two years price from 2014-2017 = RM 0.84

RISK REWARD is extremely good !

By using the average of two years price from 2014-2017 = RM 0.84

By using the future potential and half of historical price from RM 1.00 to RM 2.49 = RM 1.74

(Because historical tell us after break RM 1.00 price will super bullish)

(Because historical tell us after break RM 1.00 price will super bullish)

Current price RM 0.95.

Risk RM 0.95 - RM 0.84 = RM 0.11 <Potential lose>

Reward RM 1.74 - RM 0.95 = RM 0.79 <Potential gain>

Reward RM 1.74 - RM 0.95 = RM 0.79 <Potential gain>

Look at the chart below, will TEN YEAR BULL CYCLE FINALLY COME BACK !?

I guess the company has prepared everything for it !

I guess the company has prepared everything for it !

Once breakin RM 1.00 then brake might be rosak ! Be sure Melabur Sampai Meletup !

Don't chase after Meletup !

Risk of lose is only RM 0.11 cent but potential gain is at least RM 0.79 ! Ratio 1:7 !

Since we all already know N2N is growing and after acquire AFE Solution Ltd, their profit definitely can grow much faster, therefore the risk of falling should be very limited !

As a conclusion,

1. N2N is a growing company that still undervalue.

2. Technically has not been perform much compare to fundamental.

3. N2N after break RM 1.00 will have super rally.

4. Risk Reward is very good for investing in N2N.

2. Technically has not been perform much compare to fundamental.

3. N2N after break RM 1.00 will have super rally.

4. Risk Reward is very good for investing in N2N.

5. N2N technologies growing well with future development.

Again I further increase my short term hope to reach RM 1.20, mid term hope RM 1.74, long term hope RM 2.50.

Monday, September 4, 2017

N2N - Fundamental Analysis LTA Style

Simply due to N2N highly potential to become next JFTECH, which can Meletup from RM 0.80 all the way to RM 2.29 within just a few month time, therefore we further share our LTA views in this company.

It's so less chance to find a great profitability stock that can easily estimate and with very strong business background, therefore I have to write one more post to share my views and hope it can be same like JFTECH again!

You can find out why I like N2N on previous post at link below:

http://bursalogicanalysis.blogspot.com/2017/08/n2n-market-know-how.html

This post we will only discuss about N2N fundamentals like balance sheet, quarterly result, business details and futures prospect.

Let us study the latest quarter result first.

Looking at the latest quarterly result balance sheet,

Total cash = Deposit with Licensed Bank RM 94 million + Cash at Bank RM 38 millions

= RM 132 millions !

Total loan = Long term loan RM 74 millions + short term loan RM 2 million

= RM 76 millions

Total cash - Total loan = RM 132 million - RM 76 million = RM 56 millions

Total share issued 477 millions / RM 56 million = RM 0.117 nett cash per share.

As long as the company is nett cash, usually it deserve higher valuation !

How about cash flow is it positive?

Very positive !!

Again we read this quarterly result and to see how much potential it should be for the next few coming quarter:

We can see the obvious jump in Revenue and net profit, you should already know it's due to newly acquired company name AFE Solution Ltd which have most business in Hong Kong. To know whether how much it contributes, we can check from latest report as well:

If look at N2N PE which is almost 3.4x times lower to EFORCE !!

NTA of N2N also almost 4 time higher compare to EFORCE !!

First quarter net profit : RM 3.624 millions = 0.77 EPS

Second quarter net profit : RM 9.944 millions = 2.12 EPS

From here, we have to estimate the future already !

We use very low profit of RM 5.00 million will do. If doing better, it's going to greatly impact the PE and stock price.

Third quarter net profit estimate : RM 5.00 mil = EPS 1.04

Fourth quarter net profit estimate : RM 5.00 mil = EPS 1.04

Total EPS = 0.77+2.12+1.04+1.04 = EPS 4.97 in RM its RM 0.0497 per share.

RM 0.0497 it's about PE 21 if based on RM 1.05.

However if coming two quarter able to deliver better than just RM 5.00 million net profit (should be can since last quarter already RM 9 million), it's expect to much lower down the PE value !

(for example if Q3, Q4 post RM 7.5 mil, total EPS = RM 0.0157. Price RM 1.05/EPS 0.0603=PE 17 only.)

If earning maintain around RM 9.0 mil, then the price definitely SUPER Big Meletup Up !!

I can tell you why it worth more than just PE 20 as this is a very strong growth stock with nett cash position and strong market leader position which ensure their business and profitability and capabilities !

In Malaysia we should know that only one Competitor which is EFORCE. N2N have a long list of client too, and most importantly all these client very unlikely going to switch to other trading solution as it going to spend a lot of cost therefore N2N business is very solid and steady:

-------EXCHANGES business-------

Look very familiar right ! You might be one of their client too ! The more people trade then N2N will be benefited !When you place your order for buy stock, you may already supported N2N and help their revenues !

Now some more added Hong Kong, Vietnam, Macau, client based huge and many are from Banks which definitely value added to N2N !

It's so less chance to find a great profitability stock that can easily estimate and with very strong business background, therefore I have to write one more post to share my views and hope it can be same like JFTECH again!

You can find out why I like N2N on previous post at link below:

http://bursalogicanalysis.blogspot.com/2017/08/n2n-market-know-how.html

This post we will only discuss about N2N fundamentals like balance sheet, quarterly result, business details and futures prospect.

Let us study the latest quarter result first.

Looking at the latest quarterly result balance sheet,

Total cash = Deposit with Licensed Bank RM 94 million + Cash at Bank RM 38 millions

= RM 132 millions !

Total loan = Long term loan RM 74 millions + short term loan RM 2 million

= RM 76 millions

Total cash - Total loan = RM 132 million - RM 76 million = RM 56 millions

Total share issued 477 millions / RM 56 million = RM 0.117 nett cash per share.

As long as the company is nett cash, usually it deserve higher valuation !

How about cash flow is it positive?

Very positive !!

Again we read this quarterly result and to see how much potential it should be for the next few coming quarter:

We can see the obvious jump in Revenue and net profit, you should already know it's due to newly acquired company name AFE Solution Ltd which have most business in Hong Kong. To know whether how much it contributes, we can check from latest report as well:

We can see May result still not yet include new acquired company's contribution.

We can see obviously compare with May's quarterly result which not yet show any contribution from Hong Kong, Macau and Vietnam but in latest August quarterly result, it show the contribution from this 3 country increase extra 240 % revenue, which DOUBLE UP the revenue and also it's profit !

Let's also compare N2N direct competitor EFORCE which also provided trading solution in Malaysia.

I don't dare to compare at all !

If compare N2N price should limit up at least 3 time !! ?

EPS 4.02 x PE 75 (EFORCE current's PE) = RM 3.015 !!

N2N EPS is 2.6x times higher compare to EFORCE and yet to calculate if N2N continue to post better result then EPS might be even higher !

If look at N2N PE which is almost 3.4x times lower to EFORCE !!

NTA of N2N also almost 4 time higher compare to EFORCE !!

And yet EFORCE stock price at RM 1.10+ and N2N only RM 0.80+ ??

Since we know that the contribution from newly acquired company contribute a lot, we can roughly estimate upcoming quarterly result revenue and profit as below to project how much N2N should worth:

First quarter net profit : RM 3.624 millions = 0.77 EPS

Second quarter net profit : RM 9.944 millions = 2.12 EPS

From here, we have to estimate the future already !

We use very low profit of RM 5.00 million will do. If doing better, it's going to greatly impact the PE and stock price.

Third quarter net profit estimate : RM 5.00 mil = EPS 1.04

Fourth quarter net profit estimate : RM 5.00 mil = EPS 1.04

Total EPS = 0.77+2.12+1.04+1.04 = EPS 4.97 in RM its RM 0.0497 per share.

RM 0.0497 it's about PE 21 if based on RM 1.05.

However if coming two quarter able to deliver better than just RM 5.00 million net profit (should be can since last quarter already RM 9 million), it's expect to much lower down the PE value !

(for example if Q3, Q4 post RM 7.5 mil, total EPS = RM 0.0157. Price RM 1.05/EPS 0.0603=PE 17 only.)

If earning maintain around RM 9.0 mil, then the price definitely SUPER Big Meletup Up !!

I can tell you why it worth more than just PE 20 as this is a very strong growth stock with nett cash position and strong market leader position which ensure their business and profitability and capabilities !

In Malaysia we should know that only one Competitor which is EFORCE. N2N have a long list of client too, and most importantly all these client very unlikely going to switch to other trading solution as it going to spend a lot of cost therefore N2N business is very solid and steady:

-------EXCHANGES business-------

1)Bursa Malaysia Securities

2)Singapore Exchange Securities

3)Saudi Stock Exchange (Tadawul)

4)Jakarta Stock Exchange (JSX)

5)The Stock Trading Center of Vietnam (STC)

6)Philippine Stock Exchange (PSE)

2)Singapore Exchange Securities

3)Saudi Stock Exchange (Tadawul)

4)Jakarta Stock Exchange (JSX)

5)The Stock Trading Center of Vietnam (STC)

6)Philippine Stock Exchange (PSE)

-------MALAYSIA'S e-Broking business-------

1)Aseambankers

2)CIMB Bank

3)Citibank

4)Maybank

5)AmFraser

6)AmSecurities

7)Apex Securities

8)CIMB Securities

9)HWANGDBS

10)Kenanga Investment Bank Berhad

11)PM Securities

12)SJ Securities

13)Macquarie

14)AffinTrade

15)TA Securities

2)CIMB Bank

3)Citibank

4)Maybank

5)AmFraser

6)AmSecurities

7)Apex Securities

8)CIMB Securities

9)HWANGDBS

10)Kenanga Investment Bank Berhad

11)PM Securities

12)SJ Securities

13)Macquarie

14)AffinTrade

15)TA Securities

Look very familiar right ! You might be one of their client too ! The more people trade then N2N will be benefited !When you place your order for buy stock, you may already supported N2N and help their revenues !

Now some more added Hong Kong, Vietnam, Macau, client based huge and many are from Banks which definitely value added to N2N !

As a conclusion,

I raised my own personal "hope" for short term price to reach RM 1.10, mid term hope RM 1.50, long term hope RM 2.50.

Above are purely sharing information that might have errors cause by human mistake, miscalculation, and for education and personal reference only.

Monday, August 28, 2017

N2N Connect Bhd - The Market Know How

N2N (0108) have come into LTA radar finally because it's time for this ACE stock Gem unlock their potential fully. Why I said so? Because this company again fulfilled all my criteria to be a Meletup Stock !

At first let us understand what exactly this company doing. You can view their website

http://www.ngnconnection.com/ , http://www.n2nconnect.com/.

To make it simple and easy to understand, one of the core business is providing stock trading platform, solutions, services.

" N2N markets its core enterprise-wide integrated e-commerce securities trading solutions to local stock broking firms and banks. It also focuses on online transactions with emphasis in the capital market segments. N2N’s products and services range from online trading portals within the stock broking industry, hosting and managing network services, to wealth and risk management solutions."

This company have been started in year 2000 which almost 17 years, although their website din't show who their main customer in Malaysia, but roughly we know few bank like CIMB, AMBANK, AFFIN and some other are using their platform.

In Malaysia, we can say that only a two public listed company providing such service, N2N and EFORCE.

We don't have to say about EFORCE as we know that EFORCE valuation already quite rocket and last year has been a big bull goreng up. And even after bonus still doing quite well in term of stock price.That's why we see big Potential in N2N too.

Let us look at latest quarterly report, we found something that we always like :

Their business not just in Malaysia, but also Singapore, Indonesia, Phillipines, and lately newly added Hong Kong, Macau and Vietnam after acquired AFE Solution Ltd (we will go into more details about this company later) on 31 March 2017.

This is one of the main consent to see whether this company are sole depending on Malaysia only, or well expanded to other country. Since their business already grow well to other country, this remind us about MYEG, GHLSYS, REXIT which also expanded to other country and doing very well, because if only make business alone in Malaysia is not good enough for growth.

For Financial background, I can conclude it's a Nett Cash Company !!

For details can you go to this blogger to read HERE <--

Look at the latest quarterly result, revenue triple up ! Profit triple up ! Why is this growth so much !

Now just the beginning of what we want to share. It's all coming from this newly acquired company AFE Solution Ltd and how potential is this company?

http://www.theedgemarkets.com/article/n2n-connect-expand-asian-footprint

From link above, we learn that :

"AFE is a financial data and trading solutions provider with regional presence in Hong Kong, Macau and Vietnam. "

“The financial market in Hong Kong is huge with over 500 brokerage firms. AFE is among the top three [trading solutions] providers there. We bought AFE for their market share. Through AFE, we will have a good presence in Hong Kong, Macau and Vietnam."

“AFE’s strong presence in Hong Kong will also serve as a springboard for our expansion into China, with the Shenzhen-Hong Kong stock-trading link kicking off soon,” said Tiang. According to news reports, the trading link, dubbed the Shenzhen-Hong Kong Stock Connect, is slated to open on Dec 5. (SHENZHEN-Hong Kong already kick off)"

We know that AFE is already a very strong trading Solution Company, do you curious on its client?Wow such a long list, so much client and many are big Bank in CHINA and Hong Kong. By just looking at their client already know this company have a very strong background and high profitability in future !

How much AFE estimate each year can contribute to N2N ? From this link, we learned that AFE last year make great profit of HKD 14 million. Equal to RM 7.63 million a year.

"Besides helping N2N Connect extend its regional presence, the acquisition of the 34-year old AFE, which registered HK$110 million in revenue with HK$14 million profits in 2016, combines core technologies from two leaders in the field of capital and financial markets with AFE owning a number of intellectual property in data streaming and back office systems."

https://www.digitalnewsasia.com/business/n2n-connect-takes-big-step-towards-goal-us115mil-hk-acquisition

What is the idea of RM 7.63 million a year for N2N ?

Again we refer back to this quarterly result history.

We show you what is the impact of extra RM 7.63 million gain !

Approximately N2N each quarter only make roughly RM 2-3 mil Max a quarter.

Total earning last year was RM 11.37 million.

And now each year gain extra RM 7.63 million.

This equal to RM 7.63 / RM 11.37 = 67 % Extra !

What is the meaning 67 % extra ? Which mean the company every year earn estimate extra 67 % !

This mean stock price also should at least up 50 % ? What if AFE contribute more this year?

This year stock market definitely hot than last year. As specially Hong Kong market big bull now !

Let us look at some stock that recently also acquire new company : KRONO

KRONO after acquired QUANTUM Storage last year, then it goreng up so high 5 time up from RM 0.20.

Lets us look at N2N stock price :

We can see it has been strong sideways at range of RM 0.70 - RM 1.00. Since result has been strongly improved, I believe it can break the resistant of RM 1.00 very soon.

We check the latest quarterly result propects:

We notice N2N is still growing their service to other country and they actually also involved in Data Services similar like KRONO which people are crazily like it and goreng it.

We all know that Data Centre services is important now, therefore again we see this N2N have a lot potential in future.

Not only that they also providing those network securities, and many other IT solution. Can check it here: http://www.ngnconnection.com/

What's more?

MAINBOARD LISTING again !

N2N is the very few profit making and stable business and potential growth ACE MARKET stock that already hit requirement to move to mainboard.

Again I see a lot potential in this company and bright future, I hope you can see it too.

As a Conclusion:

1. N2N is doing International Business.

2. N2N business in Malaysia almost consider Monopoly business as very High Barrier.

3. N2N claimed themself as Asia’s largest one-stop service provider in the financial investment industry.

4. N2N is a nett cash company.

5. N2N stock price still din't really perform much over the years but profit improved.

6. N2N business fit with current market needs, online solution, data, IT.

7. N2N earning improved a lot after acquired AFE Solution LTD.

8. N2N still list at ACE market, which potential transfer to Mainboard in future.

9. N2N technically bullish with volume, sign of black horse awake.

My own personal "hope" for short term price to reach RM 1.05, mid term hope RM 1.30, long term hope RM 2.00.

Wednesday, May 3, 2017

MLGLOBAL - The Rise Of LBS Construction Arm

As if you still not yet read my first introduction about MLGLOBAL, please come here first:

http://bursalogicanalysis.blogspot.my/2017/04/mlglobal-quality-service-in.html

As for this post, I will share some more information found out from MLGLOBAL (7595).

As previous post we mentioned that MLGLOBAL actually is a new construction company, mainly due to LBS injected their construction company MITCE into MLGLOBAL.

Since MLGLOBAL just release its annual report last week, we look through the TOP 30 largest share holder, and you will find that LBS and their Boss hold almost 60-70% of MLGLOBAL shares.

ONE MORE even EXCITING FACTS !

Out of TOP 30 shareholder, 20 are all from famous fund house !~!

I am strongly believe that all these fund house confident with MLGLOBAL futures, that's why most of them invested into this company. Look at those key name, Growth Fund, Eastspring Investment Dynamic Fund, even KWP, Tenaga National Fund, KWS Guru, we can conclude this company will definately a stable because of so many strong fund supporting.

Secondly,

From LBS annual report, we also can see it mentioned that LBS owned MLGLOBAL 55.34% !!

To further assure MLGLOBAL would have growth prospect, we first believe to check on LBS future prospect, because many projects are coming from LBS.

From LBS Annual report, they have 16 ongoing projects with total GDV of RM 2.90 billion ! Not to mention that they still have huge land bank of 3962 arcres, which about GDV of RM 29.80 billion !! It's very huge number !!

Interestingly, in LBS annual report, they also cover some details of MLGLOBAL, which they name it their Construction Division, and we can see 85% of revenue are coming from LBS !

With LBS management and leadership in MLGLOBAL, I am fully confident and believe that MLGLOBAL can do well in future.

After study throughout both LBS and MLGLOBAL annual report,

I further raise my own hope for short term price to RM 1.50, mid term RM 2.00, long term RM 3.00.

http://bursalogicanalysis.blogspot.my/2017/04/mlglobal-quality-service-in.html

As for this post, I will share some more information found out from MLGLOBAL (7595).

As previous post we mentioned that MLGLOBAL actually is a new construction company, mainly due to LBS injected their construction company MITCE into MLGLOBAL.

Since MLGLOBAL just release its annual report last week, we look through the TOP 30 largest share holder, and you will find that LBS and their Boss hold almost 60-70% of MLGLOBAL shares.

ONE MORE even EXCITING FACTS !

I am strongly believe that all these fund house confident with MLGLOBAL futures, that's why most of them invested into this company. Look at those key name, Growth Fund, Eastspring Investment Dynamic Fund, even KWP, Tenaga National Fund, KWS Guru, we can conclude this company will definately a stable because of so many strong fund supporting.

Secondly,

From LBS annual report, we also can see it mentioned that LBS owned MLGLOBAL 55.34% !!

To further assure MLGLOBAL would have growth prospect, we first believe to check on LBS future prospect, because many projects are coming from LBS.

From LBS Annual report, they have 16 ongoing projects with total GDV of RM 2.90 billion ! Not to mention that they still have huge land bank of 3962 arcres, which about GDV of RM 29.80 billion !! It's very huge number !!

Interestingly, in LBS annual report, they also cover some details of MLGLOBAL, which they name it their Construction Division, and we can see 85% of revenue are coming from LBS !

With LBS management and leadership in MLGLOBAL, I am fully confident and believe that MLGLOBAL can do well in future.

After study throughout both LBS and MLGLOBAL annual report,

I further raise my own hope for short term price to RM 1.50, mid term RM 2.00, long term RM 3.00.

Subscribe to:

Posts (Atom)