WCT, MRCB, BPLANT, FGV <--- We looking at it

Well, when glove stock have become the top spotlight of BURSA, many have actually neglecting the rest of all other sector in Bursa.

After last week of crazy rally in

Property stock and Automotive stock, I believe that investor or trader should start to pay more attention at other sector that still have big room to go up, as many sector have yet to recover much from recent rebound.

Before that,

If you missed our call on automotive and property stock like

DRBHCOM, UMW, SPSETIA, MAHSING, ECOWLD and others last week, you may consider to join our free telegram live trading channel :

https://t.me/ltachannel <-- to join

Below are a few sector and stock that posing good technical :

CONSTRUCTION SECTOR:

Since property stock have turn rally up, the indirect beneficial will be surely

construction stock. We already see

ECRL start awarding contract to

GADANG and

HOHUP, we expecting more are coming, and more mega project will start awarding contract.

After scanning through, we have selected two construction stock that have a good technical movement.

WCT (9679)

WCT have definitely building bottom after a long sell down, we can see huge volume building at this bottom, if this week price turn up, then will be a strong direction to go up already.

Technically Last week closing exactly at RM 0.525.

Support RM 0.525 ,

Resistant RM 0.56 & RM 0.58,

Once break the resistant price will shoot all the way to next resistant RM 0.70.

Risk reward looking good.

Boss also have been being aggressively.

MRCB (1651)

MARCB also building bottom after a long sell down, we can see huge volume building at this bottom, if this week price turn up, then will be a strong direction to go up already.

Technically Last week closing exactly at RM 0.54.

Support RM 0.53,

Resistant RM 0.57.

Once break the resistant price will shoot all the way to next resistant RM 0.70.

We expecting this two company going to benefited from all the mega project that going to resume works such as MRT, HSR, LRT and many more.

PLANTATION SECTOR

FGV & BPLANT

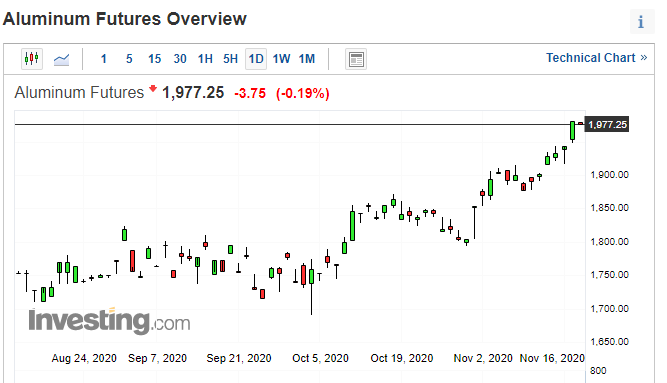

Well, beside construction definitely plantation stock still being laggards in this recent rally. We sense that some rally will come into this sector as few reason below:

After recent new government in action, we can see that the government actually very business and stock market friendly, almost every sector been under cover, that's why even Property and Automotive stock rally. So with latest National Economic Revitalisation Plan, plantation stock is one of the beneficiary besides property and automotive, the 100% exemption on export duty on crude palm oil, crude palm kernel oil and processed palm kernel oil from July 1 to Dec 31, 2020, expecting plantation stock can move higher up.

Besides, we see that CPO price has been strong rebound recover up from bottom as well, this will bode well for plantation stock in Malaysia as most of the plantation stock movement are following the CPO movement.

Stock we have selected a few plantation stock such as:

FGV (5222)

FGV can be said that is the leader of all plantation stock in Malaysia, that's why the movement are highly valuable to be monitor and if it can turn higher up, the rest will follow.

Technically Last week closing exactly at RM 1.11.

Support RM 1.08,

Resistant RM 1.16 & RM 1.20,

Once break the resistant price will shoot all the way to next resistant RM 1.35.

BPLANT (5254)

Since

BSTEAD have news saying looking for privatization at RM 0.80, we expecting that the company

BSTEAD holding like

BPLANT will be realize big value as it's very normal for accounting measure to check on how much value

BPLANT will create for BSTEAD so whether the take over is worth value or under value.

Much interestingly, in bigger view,

BPLANT already at the point for direction.

In shorter view,

BPLANT already breaking the downtrend line and is very ready to breakout and spike higher up.

Technically Last week closing exactly at RM 0.395.

Support RM 0.37,

Resistant RM 0.40.

Once break the resistant price will shoot all the way to next resistant

RM 0.58.

.jpg)